Forex Brokers With No Deposit Bonus

Want to trade stocks, forex, cryptocurrencies, and more than without putting any coin down? With a no eolith bonus broker, yous can! In this guide, nosotros'll reveal the 10 best no deposit bonus brokers South Africa for 2022.

67% of retail investor accounts lose money when trading CFDs with this provider.

In This Guide

- 1 Best No Deposit Bonus Brokers South Africa 2022

- 2 Best Brokers with Bonus S Africa Reviewed

- 2.1 1. Libertex – All-time Bonus Banker Due south Africa with MetaTrader 4

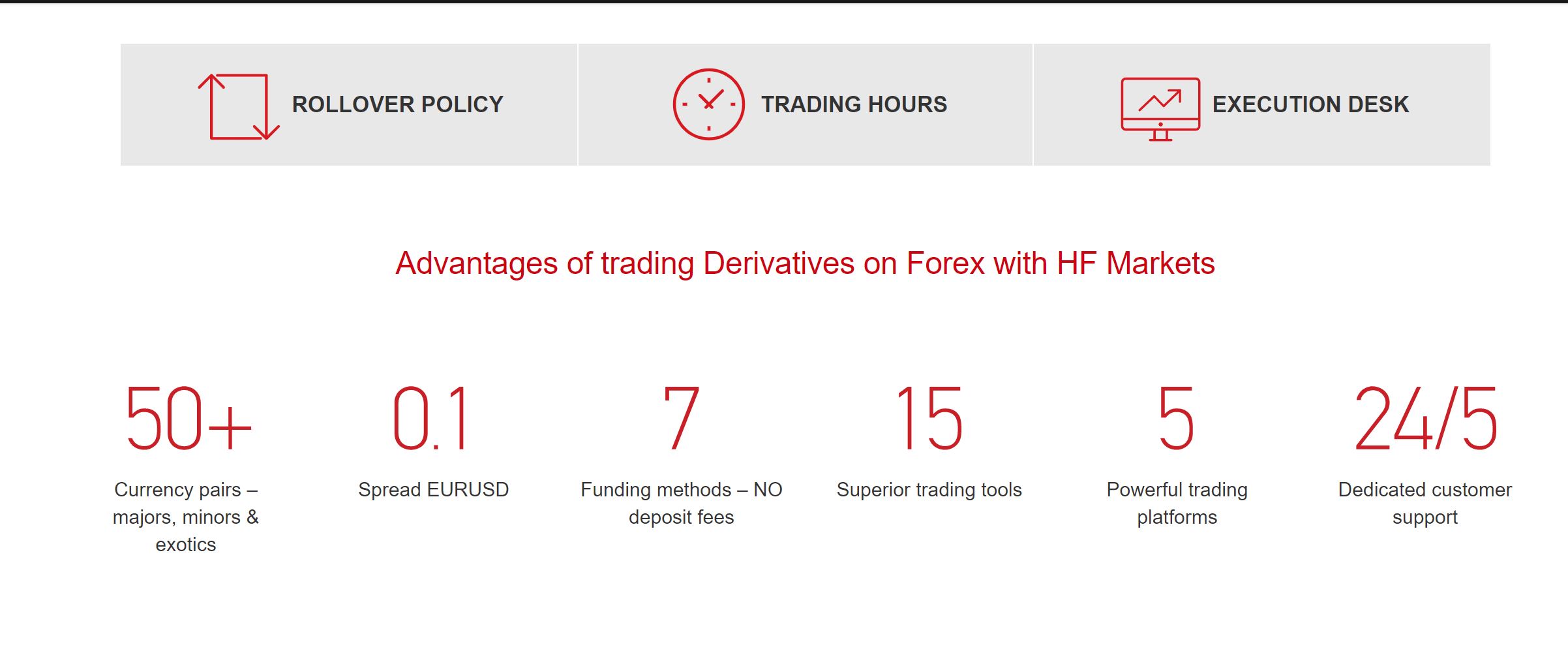

- two.ii 2. Capital.com - Best Pick of Forex Pairs to Trade at a Bonus Broker

- 2.iii 3. AvaTrade - Best South Africa Forex Bonus Broker with Options Trading

- 2.four iv. Plus500 - Pinnacle Multi-asset Bonus Broker with Ultra-low Spreads

- 2.5 v. XM - Best No Deposit Bonus Stock Broker in S Africa

- ii.6 half dozen. FBS - Specialised Accounts for Forex & Stock Trading with $140 No Deposit Bonus

- 2.7 7. FP Markets - No Eolith Bonus Forex Broker with Social and Auto Trading Features

- 2.eight 8. TemplerFX - Best Offshore Broker with No Deposit Bonus

- two.9 9. EMD Finance - Best Forex Broker with No Eolith Bonus for High Leverage

- iii Brokers with Bonus Comparing

- 4 How to Cull the Right Bonus Broker for You

- v How to Get Started with a Bonus Broker

- 5.1 Step 1: Create an Account

- 5.ii Stride 2: Verify Your Identity

- v.3 Footstep 3: Fund Your Account

- 5.four Pace 4: Outset Trading Cryptocurrency

- half dozen All-time No Eolith Bonus Brokers South Africa - Conclusion

- 7 Upper-case letter - All-time No Deposit Bonus Broker in South Africa

- 8 FAQs

- eight.ane Can I withdraw the bonus coin from a no deposit bonus broker?

- viii.two Do I take to pay back bonus coin if I lose information technology while trading?

- 8.three What assets can I merchandise with a no deposit bonus banker?

- 8.4 Are no deposit bonus brokers regulated?

- eight.5 Do bonus brokers crave a deposit to open an account?

Best No Eolith Bonus Brokers South Africa 2022

Hither are the 10 best no deposit bonus brokers in Due south Africa for 2022, you can observe more detail in our full reviews when you lot scroll down:

- Libertex – Best Bonus Broker with MetaTrader 4

- Capital.com – Best Option of Forex Pairs to Trade at a Bonus Broker

- AvaTrade – Best South Africa Forex Options Banker with No Eolith Bonus

- Plus500 – Summit Multi-asset Bonus Broker with Ultra-low Spreads

- XM – Best No Deposit Bonus Stock Banker in South Africa

- FBS – Specialised Accounts for Forex & Stock Trading with $140 No Deposit Bonus

- FP Markets – No Deposit Bonus Forex Broker with Social and Auto Trading Features

- TemplerFX – Best Offshore Broker with No Deposit Bonus

- EMD Finance – Best Forex Broker with No Deposit Bonus for High Leverage

five Providers that friction match your filters

Payment methods

Account Fees

$ 20 per Month

What we like

- Merchandise Share CFDs with 0% Commission

- Broad Range of Payment Options

- Trade Major

Account Fees

Mobile App

Payment methods

By profits do non guarantee time to come profits.

What nosotros like

- No spreads

- Educational content

- User-friendly platform

Fixed fees per trade

Account Fees

Mobile App

CFDs are complex instruments and come with a loftier adventure of losing money quickly due to leverage. 75.three% of retail investor accounts lose coin when trading CFDs with this provider.

What we like

- Low fees

- Supports algo trading

- High quality charting

Business relationship Fees

Mobile App

66% of retail investor accounts lose coin when trading CFDs with this provider.

What nosotros like

- No deposit or withdrawal fees

- Trade major forex pairs such as EUR/USD with leverage upwards to 30:i and tight spreads of 0.ix pips.

- Depression $100 minimum eolith to open a trading account

Account Fees

Mobile App

Account Information

$50 after 3 months, $100 subsequently 12 months

71% of retail investor accounts lose money when trading CFDs with this provider.

Account Information

$fifty afterwards 3 months, $100 after 12 months

What nosotros like

- Trade Volatility 75 with cTrader

- Integrates with MT4 and MT5 trading platforms

- Very low VIX trading spreads

Account Fees

Mobile App

Payment methods

lxxx.eighteen%% of retail investor accounts lose money when trading CFDs with this provider.

Best Brokers with Bonus Due south Africa Reviewed

Let's take a closer look at the all-time no deposit bonus brokers Due south Africa so yous can determine which one is correct for yous.

1. Libertex – Best Bonus Banker South Africa with MetaTrader 4

Libertex is one of the best forex brokers with a bonus in South Africa. To become started, you lot must make a minimum eolith of $100 (ane,500 ZAR) to open up a new account. As you merchandise and pay commissions, Libertex gives y'all a x% rebate on all commissions paid. The limit on how big your bonus can be is based on your initial deposit when yous open an account, and tin be upwardly to $x,000 (150,000 ZAR).

Libertex is one of the best forex brokers with a bonus in South Africa. To become started, you lot must make a minimum eolith of $100 (ane,500 ZAR) to open up a new account. As you merchandise and pay commissions, Libertex gives y'all a x% rebate on all commissions paid. The limit on how big your bonus can be is based on your initial deposit when yous open an account, and tin be upwardly to $x,000 (150,000 ZAR).

The bonus at Libertex is closely tied to the broker's fee construction, which uses fixed commissions instead of variable spreads. While nosotros typically don't encourage traders to pay commissions, Libertex's pricing structure is actually very favourable. The trade commission for the EUR/USD forex pair is just 0.008%, which is lower than the 0.01% spread that's standard for the manufacture.

Libertex likewise stands out for giving traders access to the popular MetaTrader four platform. This forex trading platform is available for spider web and mobile, and includes hundreds of congenital-in indicators. Information technology also supports customisable forex signals and strategy backtesting, and even enables you to lawmaking your own technical studies.

Libertex also has its own proprietary trading platform, which you tin can use to merchandise shares, commodities, cryptocurrencies and indices with this broker. Libertex carries CFDs for dozens of popular United states stocks likewise equally a broad range of popular cryptocurrencies.

Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker offers customer support by email only.

Pros:

- Bonus upward to $10,000 (150,000 ZAR) available

- Stock-still commissions are cheaper than spreads

- Includes MetaTrader 4 and MetaTrader five

- Merchandise stocks, commodities, crypto, and indices

- Regulated by CySEC

Cons:

- Minimum $100 (1,500 ZAR) deposit to open up account

- Bonus size depends on the size of your initial deposit

Your capital is at take a chance.

two. Capital letter.com - Best Choice of Forex Pairs to Trade at a Bonus Banker

Capital.com is another selection for South African forex traders looking for the best forex brokers with a bonus. This brokerage offers 100% commission-free trading on a whopping 142 currency pairs, which means you'll have no shortage of minor and exotic forex pairs to trade. In addition, Upper-case letter.com is a multi-asset CFD broker with over 3,000 shares and dozens of indices and commodities bachelor for trading.

Capital.com is another selection for South African forex traders looking for the best forex brokers with a bonus. This brokerage offers 100% commission-free trading on a whopping 142 currency pairs, which means you'll have no shortage of minor and exotic forex pairs to trade. In addition, Upper-case letter.com is a multi-asset CFD broker with over 3,000 shares and dozens of indices and commodities bachelor for trading.

The bonus at Capital.com isn't entirely eolith-free, but it'southward close. You can open an account at this broker with merely $20 (300 ZAR). When you place a unmarried trade within xxx days of opening your account, you automatically get $50 (750 ZAR) deposited in your account.

Capital.com doesn't accept a withdrawal fee, so you're free to withdraw your initial deposit at any fourth dimension later on receiving the bonus money. Just note that yous can't withdraw the bonus money until you've made at least $500,000 (vii.5 meg ZAR) in trades.

This broker is more than simply a source of free greenbacks for trading. It'southward as well a meridian-tier trading platform that offers a wealth of tools. Capital.com has a custom web and mobile interface with dozens of technical indicators, watchlists, a news feed, and more. Information technology doesn't back up forex signals, which is a downside for more than experienced traders, only it does have chance direction options similar abaft end orders.

Capital.com is regulated by the FCA and CySEC. The broker offers exceptional client back up, with representatives bachelor 24/seven by phone, email, and live chat.

Pros:

- Trade 142 forex pairs with no commissions

- $fifty (750 ZAR) bonus after making only one trade

- $twenty (300) ZAR minimum deposit and no withdrawal fees

- Advanced trading platform for spider web and mobile

- 24/7 customer support

Cons:

- Doesn't back up forex signals

Your capital is at gamble.

three. AvaTrade - All-time Due south Africa Forex Bonus Broker with Options Trading

AvaTrade is one of the top forex brokers with a no eolith bonus in South Africa. Y'all can sign up with no money downwards and receive $fifty (750 ZAR) instantly. There's no strings attached, and you can fifty-fifty withdraw the bonus money afterwards placing $10,000 (150,000 ZAR) in trades.

AvaTrade is one of the top forex brokers with a no eolith bonus in South Africa. Y'all can sign up with no money downwards and receive $fifty (750 ZAR) instantly. There's no strings attached, and you can fifty-fifty withdraw the bonus money afterwards placing $10,000 (150,000 ZAR) in trades.

AvaTrade offers 55 currency pairs as CFDs, but what really sets this platform apart is that you can trade forex options. The broker's custom AvaOptions platform is built specifically for this purpose and gives yous the power to craft circuitous strategies with multi-option orders. In fact, information technology comes with a handful of premade strategies that you can apply and gives you the power to generate steady income by writing put and phone call orders.

This broker too supports MetaTrader 4 and v, as well every bit its own proprietary web and mobile trading platform. Having access to MetaTrader is a major plus for more advanced traders as this gives you the power to trade with forex signals. AvaTrade also has a social trading network, called AvaSocial, where yous can connect with thousands of other traders from effectually the earth.

While AvaTrade is built with experienced traders in mind, information technology offers a scattering of educational resources for novices. For example, the banker offers a guide to technical indicators and an introduction to popular technical trading strategies. AvaTrade also has an like shooting fish in a barrel to use demo account and a library of videos to assistance you dive into trading.

AvaTrade is regulated by the FSCA in Due south Africa, the Australian Securities and Investments Committee (ASIC), and the Key Banking company of Ireland. The banker offers 24/5 customer back up past phone, email, and live conversation.

Pros:

- $50 (750 ZAR) no deposit bonus

- Supports forex options trading with dedicated mobile platform

- Integration with MetaTrader 4 and MetaTrader 5

- Social trading through AvaSocial

- Regulated in South Africa

Cons:

- High inactivity fee ($50/750 ZAR per quarter afterwards 3 months)

Your majuscule is at hazard.

iv. Plus500 - Pinnacle Multi-asset Bonus Banker with Ultra-low Spreads

Plus500 is an excellent bonus banker for South African traders who desire access to a wide variety of instruments. This platform offers CFDs for 1,900 global shares, 70 currency pairs, fourteen cryptocurrencies, and 25 bolt.

Plus500 is an excellent bonus banker for South African traders who desire access to a wide variety of instruments. This platform offers CFDs for 1,900 global shares, 70 currency pairs, fourteen cryptocurrencies, and 25 bolt.

Plus500 has some of the lowest spreads we've seen in South Africa. The broker charges an boilerplate spread of merely 0.7 pips (0.007%) for the EUR/USD trading pair and 0.5 pips for the South&P 500 index CFD. On peak of that, you tin can access leverage up to 30:one at Plus500, and then information technology's easy to make big bets with just a small pot of money for trading.

This broker helps you lot get started with a $thirty (425 ZAR) no eolith bonus. If yous want to add funds to your account, the broker requires a minimum deposit of $100 (1,500 ZAR). We especially like that Plus500 offers ZAR forex accounts and that you lot can deposit funds using e-wallets similar PayPal.

Plus500's trading platform is piece of cake to use, especially for traders who are only starting out. The platform includes dozens of built-in technical indicators along with a news feed and economic calendar. Plus500 likewise supports guaranteed stops, which can lock in a sell cost even when the market drops suddenly. Even so, forex traders volition want to notation that Plus500'due south platform doesn't support forex signals.

Plus500 is regulated past the UK FCA and the Financial Sector Conduct Say-so (FSCA) in Due south Africa. The broker offers 24/7 customer back up by alive chat and electronic mail.

Pros:

- $30 (425 ZAR) no deposit bonus

- Trade shares, forex, crypto, and commodities

- 100% commission-free with very low spreads

- Supports ZAR accounts and accepts PayPal payments

- Regulated in South Africa with 24/seven support

Cons:

- Trading platform doesn't support forex signals

Your capital is at hazard.

5. XM - Best No Eolith Bonus Stock Broker in S Africa

XM offers new traders a $25 (375 ZAR) no eolith bonus with no strings attached. That's not every bit generous equally what some other brokers offer, simply the fact that XM offers accounts with a minimum deposit of just $5 (75 ZAR) is a huge plus. In addition, XM offers accounts denominated in ZAR for trading forex and CFDs.

XM offers new traders a $25 (375 ZAR) no eolith bonus with no strings attached. That's not every bit generous equally what some other brokers offer, simply the fact that XM offers accounts with a minimum deposit of just $5 (75 ZAR) is a huge plus. In addition, XM offers accounts denominated in ZAR for trading forex and CFDs.

This broker is one of our summit picks for trading stocks in South Africa. The broker carries CFDs for over i,200 global shares, and South African traders accept the option to buy shares outright as well. XM charges a commission of just 0.04% when buying US shares outright, and you can employ leverage up to 5:1 when trading shares through CFDs.

XM also carries CFDs for forex, commodities, stock indices, and bolt, but not for cryptocurrencies. Traders can choose between several unlike account types, which offer spreads as low as 0 pips on major currency pairs.

XM doesn't have its own trading platform, merely instead gives traders admission to MetaTrader 4 and MetaTrader 5. These platforms can have a steep learning curve, especially for those who are new to trading. However, for experienced traders, these platforms offer key features similar strategy backtesting, customisable alerts, and personalised indicators. XM likewise has a VPS (virtual individual server) available for high-frequency trading.

XM is regulated by CySEC and the International Financial Services Committee (IFSC) in Belize. The broker offers 24/v customer service over the phone and by live chat.

Pros:

- $25 (375 ZAR) no deposit bonus when you lot sign up

- Commissions as low equally 0.04% to buy US shares outright

- Zero-spread account options for forex trading

- MetaTrader 4 and MetaTrader 5 platforms

- Regulated by CySEC and the IFSC in Belize

Cons:

- Petty fundamental data nigh stocks available

Your capital letter is at take a chance.

6. FBS - Specialised Accounts for Forex & Stock Trading with $140 No Deposit Bonus

FBS is a Due south African forex and CFD banker that offers trading on 37 currency pairs likewise equally shares, indices, and commodities. The broker charges spreads equally low equally 0.6 pips for major forex pairs, making it one of the cheapest forex brokers with a no deposit bonus in South Africa.

FBS is a Due south African forex and CFD banker that offers trading on 37 currency pairs likewise equally shares, indices, and commodities. The broker charges spreads equally low equally 0.6 pips for major forex pairs, making it one of the cheapest forex brokers with a no deposit bonus in South Africa.

FBS offers a bonus of up to $140 (2,000 ZAR) when you sign upwards for an account as part of its Level Up promotion. Yous get $70 (1,000 ZAR) when you create an account on the web platform, and another $70 when yous download and start trading with the FBS mobile app.

One neat matter about FBS is that the broker offers v different types of accounts to meet the needs of every trader. The account options differ in how much you have to deposit (from $1 or xv ZAR with a Cent business relationship), the amount of leverage y'all can apply to your trades (up to 3,000:1), and whether yous pay based on fixed or floating spreads.

Another overnice thing about FBS is that the banker supports copy trading through the MetaTrader 4 platform. FBS also offers its ain custom web and mobile trading app, called FBS Trader, too as MetaTrader 5.

FBS is regulated by CySEC and the broker offers 24/7 client support by phone and email.

Pros:

- $140 (2,000 ZAR) bonus with no deposit

- Forex spreads as low as 0.half dozen pips

- Cull from 5 dissimilar business relationship options

- Supports copy trading with MetaTrader 4

- 24/7 telephone and email support

Cons:

- Complicated pricing construction mixes spreads and commissions

Your capital is at risk.

7. FP Markets - No Deposit Bonus Forex Broker with Social and Motorcar Trading Features

![]() FP Markets is an Australian CFD broker that offers forex trading, stock trading, index trading, and commodity trading. The banker offers a Welcome Pack for new traders that includes $30 (450 ZAR) with no strings attached.

FP Markets is an Australian CFD broker that offers forex trading, stock trading, index trading, and commodity trading. The banker offers a Welcome Pack for new traders that includes $30 (450 ZAR) with no strings attached.

This banker offers a huge range of tools, which makes it very appealing for advanced forex traders in South Africa. The banker has iii different trading platforms to choose from: MetaTrader four, MetaTrader 5, and Iress. Iress is a straight market admission (DMA) trading platform that comes with 59 technical indicators, highly customisable chart layouts, and advanced club management options.

FP Markets as well gives you access to Myfxbook Autotrade, an algorithmic trading platform that integrates with MetaTrader 4. This integration is easy to employ for first-time auto traders, and it enables you to rail your functioning and place weak spots over time.

In improver, FP Markets supports copy trading through MetaTrader 4 and 5. There is no limit on the number of providers you tin can re-create, and you can turn individual traders on or off at any time to customise your trading even while copying.

FP Markets is regulated by ASIC in Commonwealth of australia. The broker only offers customer support during trading hours.

Pros:

- $30 (450 ZAR) no deposit bonus

- Supports MT4, MT5, and Iress platforms

- Integrates with Myfxbook Autotrade

- Supports copy trading with MT4 and MT5

- Regulated past ASIC

Cons:

- Customer support during market place hours only

Your uppercase is at risk.

viii. TemplerFX - Best Offshore Banker with No Eolith Bonus

TemplerFX is an offshore forex broker that offers a $thirty (450 ZAR) bonus simply for opening an account. Yous don't have to deposit any of your ain funds, just verify your identity and start trading.

TemplerFX is an offshore forex broker that offers a $thirty (450 ZAR) bonus simply for opening an account. Yous don't have to deposit any of your ain funds, just verify your identity and start trading.

TemplerFX also offers another promotions, including a loyalty bonus when you brand a deposit. For every year you've held an account with this broker, you lot'll get an extra 1% added to your deposit.

Before you start trading with TemplerFX, information technology'south important to annotation that this broker isn't regulated by any financial authority. That means that there are no protections similar negative residue protection or a guarantee of your funds in the outcome that the banker goes out of business organisation. We more often than not only recommend regulated brokers because of the safety they provide, but TemplerFX's sign-up bonus is an attractive offer.

One advantage to trading with an unregulated broker is that TemplerFX is not subject to leverage limitations. With this broker, you lot can trade major forex pairs with leverage upwardly to 1,000:1 and share CFDs with leverage of 50:1. Currency pairs are typically traded in lots of 100,000.

TemplerFX offers its own proprietary trading platform, as well as integrations for MetaTrader 4 and MetaTrader 5. The broker offers customer back up by phone, email, and live conversation.

Pros:

- $xxx (450 ZAR) no deposit bonus

- 1% loyalty bonus for every yr you've held an account

- Trade with 1,000:one leverage for major forex pairs

- Supports MetaTrader four and MetaTrader v platforms

- Offers segregated trading accounts

Cons:

- Not regulated past any financial authority

Your capital is at take a chance.

9. EMD Finance - Best Forex Banker with No Deposit Bonus for Loftier Leverage

EMD Finance is a global CFD banker that offers trading on shares, forex, commodities, and cryptocurrencies. The platform stands out for offering very high leverage, up to 500:one, for forex trading and gold trading. In improver, EMD Finance charges no commissions with a standard trading account and spreads start as low every bit 0.ane pips.

EMD Finance is a global CFD banker that offers trading on shares, forex, commodities, and cryptocurrencies. The platform stands out for offering very high leverage, up to 500:one, for forex trading and gold trading. In improver, EMD Finance charges no commissions with a standard trading account and spreads start as low every bit 0.ane pips.

This brokerage makes it easy to get started risk-gratis cheers to a $25 (375 ZAR) no eolith bonus. All yous take to do is verify your identity to open an business relationship, and you tin offset trading with the funds correct away. Y'all must trade at to the lowest degree twenty lots with EMD Finance before you are able to withdraw the bonus money.

EMD Finance only offers the MetaTrader 5 trading platform, although that's hardly a problem since that's the preferred platform for nearly advanced traders in any case. However, the broker doesn't offer a news feed, economic calendar, or custom trading signals to aid you become off the ground. And so, it tin can be hard for newer traders to break into forex with this brokerage.

All EMD Finance accounts come up with negative residual protection, which is a plus given the loftier leverage this broker offers. In addition, the banker allows you to open up ECN (Electronic Communications Network) accounts for faster trade execution and offers Islamic accounts that eliminate swap charges.

EMD Finance is regulated in St. Vincent and the Grenadines. The banker does not offer customer support.

Pros:

- Trade with leverage up to 500:i

- No eolith promotion of $25 (375 ZAR)

- Includes MetaTrader 5 trading platform

- Supports ECN and Islamic accounts

- Licensed and regulated

Cons:

- No news feed or economic calendar

- Does not offer customer support

Your upper-case letter is at adventure.

Brokers with Bonus Comparing

| Bonus Amount | Deposit Required | Other Restrictions | |

| Libertex | $100 | $100 | Bonus is matched to initial deposit, up to $10,000 |

| Upper-case letter.com | $50 | $twenty | Must place a trade |

| Plus500 | $30 | None | None |

| AvaTrade | $50 | None | None |

| XM | $25 | None | None |

| FBS | $140 | None | None |

| FP Markets | $xxx | None | None |

| Templer FX | $30 | None | None |

| EMD Finance | $25 | None | None |

How to Choose the Right Bonus Broker for You

Choosing the all-time no deposit bonus broker in South Africa depends on a few different factors. Let's take a look at the most important ones you need to consider.

Regulation

The best place to start when because a bonus banker is to look at whether it's regulated and by what agency. All of the brokers nosotros highlighted, except for TemplerFX, are licensed and regulated by governmental agencies. Top regulators include the United kingdom'southward FCA, CySEC, the FSCA in S Africa, and ASIC.

Bonus Size and Rules

The size of the bonus beingness offered is extremely important. Near brokers offer simply a small bonus to encourage y'all to get started and to enable yous to effort out the platform risk-free. Notwithstanding, some offer much larger bonuses - for example, with Libertex, you can qualify for up to $x,000 in bonus funds.

In add-on, be certain to study the rules for how to become the promised bonus closely. No deposit bonus brokers enable y'all to go the funds just past signing upwardly and verifying your identity.

Other bonus brokers may crave you to brand a minimum deposit, and so release your funds only after a certain number of trades. In some cases, the size of your bonus may be linked to your trading book or initial deposit.

Tradable Assets

The types of assets you can trade is another factor to consider when choosing a bonus broker in South Africa. No eolith bonuses are common among forex brokers, but many of the brokers nosotros highlighted also offer trading on shares, commodities, indices, and cryptocurrencies. AvaTrade also offers forex options trading, which few other bonus brokers enable.

Carefully consider what you lot plan to merchandise and whether a prospective broker offers that instrument. In add-on, it's a skillful idea to wait at how much leverage you tin merchandise with and what your costs for trading a given asset class will be.

Trading Platforms

A broker's trading platform is extremely important, since this is what you'll utilise not only to place trades just besides to run analyses and make large trading decisions.

Many of the brokers with a bonus that we reviewed support the MetaTrader iv and MetaTrader 5 trading platforms, which are highly popular among forex and CFD traders. They offer customisable charts, forex signals, and strategy backtesting.

Notwithstanding, some brokers have their own proprietary trading platforms that can be just as powerful and offer some unique features.

How to Go Started with a Bonus Banker

Ready to start trading with i of the bonus brokers in South Africa? We'll show you lot how to claim your bonus with Capital, which offers $500 when y'all trade $5,000 worth of cryptocurrency.

Let's take a closer expect at how you tin go started:

Step 1: Create an Account

The starting time step to trading with Upper-case letter is to create a new account. You lot can join using the Capital.com website or past downloading the mobile app.

Just click or tap 'Join Now' and enter your name and e-mail to create a new account. You lot can also sign upwardly using your Google or Facebook login information.

Stride 2: Verify Your Identity

In order to comply with the FCA'south anti-coin laundering regulations, Uppercase requires you to verify your identity. Upload a copy of your driver's license or the photo page of your passport. Y'all volition besides demand to upload a copy of a proof of address, such as a fiscal statement or utility beak.

Step iii: Fund Your Business relationship

Uppercase does require you to make a deposit earlier yous tin can access your bonus. The broker requires a minimum deposit of $200 (three,000 ZAR), which yous tin pay past credit card, debit bill of fare, bank transfer, PayPal, Neteller, or Skrill.

Step 4: Start Trading Cryptocurrency

To start trading cryptocurrency, head to the Upper-case letter dashboard and search for the coin you want to trade. Click on the digital currency when it appears so click 'Trade' to open a new order form.

In the order class, enter the amount of money you lot want to trade (yous must merchandise at least 750 ZAR). Then select how much leverage you want to apply to your trade, up to 2:i, and select a stop-loss price and accept-profit cost co-ordinate to your trading strategy.

When your merchandise is ready, click 'Open Trade' to execute your order. Once y'all accomplish $5,000 in cryptocurrency trading volume, Capital will automatically deposit the bonus in your account.

Best No Eolith Bonus Brokers South Africa - Determination

Opening an business relationship with a no deposit bonus broker allows y'all to offset trading immediately without risking whatsoever of your own money. Plus, many of the best no deposit bonus brokers in South Africa allow you to trade multiple assets, including stocks, forex, commodities, cryptocurrencies, and more.

Ready to go started with the all-time no deposit bonus brokers Southward Africa? Click the link below to open an Capital account.

Majuscule - All-time No Eolith Bonus Broker in S Africa

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Tin I withdraw the bonus money from a no eolith bonus broker?

You tin can withdraw the bonus money from your bonus broker, simply just subsequently reaching a certain trading volume. The required trading book varies by broker, but is typically 5-20 lots for forex trading.

Do I have to pay back bonus money if I lose it while trading?

No, y'all practise non have to pay back bonus funds if y'all lose them trading. However, nearly brokers merely offering a single bonus, and then y'all will have to eolith your own funds to continue trading.

What assets tin can I trade with a no deposit bonus broker?

Many of the all-time brokers with bonus promotions in South Africa allow you to trade CFDs for stocks, forex, commodities, indices, and cryptocurrencies. Some, like Majuscule, allow you to trade stocks and cryptocurrencies outright.

Are no eolith bonus brokers regulated?

All of the best bonus brokers nosotros highlighted, with the exception of TemplerFX, are regulated by fiscal watchdogs.

Do bonus brokers require a deposit to open an business relationship?

Many bonus brokers in Southward Africa don't crave you lot to deposit your own funds in guild to open up an account and start trading. However, some brokers do require y'all to brand a deposit and give you your bonus after.

Source: https://tradingplatforms.com/za/brokers-with-bonus/

Posted by: gonsalezfachather.blogspot.com

0 Response to "Forex Brokers With No Deposit Bonus"

Post a Comment